[Reading Time: 7 minutes]

(Or as hard-core Bitcoiners want it, I should say.)

Rocky week for the crypto-currency world this past one! All of the following happened over the course of the last seven to ten days:

- Liberty Reserve (LR) was shut down, and its management indicted and arrested, in what is being described as “the largest money laundering case in U.S. history.” A short video at the bottom explains how the case went down.

- FinCEN designated LR as entity “of primary money laundering concern,” and proposed a rule to order that all large financial institutions freeze any and all of LR’s assets.

- A brouhaha ensued, and all kinds of speculations were made about the future of Bitcoin and all virtual currencies.

- OKPay suspended processing for all Bitcoin exchanges, including Mt. Gox.

- FinCEN Director Shasky Calvery spoke out and drew the line even deeper in the sand –“We stand by the guidance.”

- Mt. Gox hardened its interface by incorporating customer verification.

- Phew!

The events of the past few weeks have marked a turning point in the history of Bitcoin product design. It’s unmistakably clear at this point that:

- Bitcoin can no longer be anonymous.

- U.S. regulation can no longer be ignored.

- Substance has to accompany form.

This is the reason for my title –Bitcoin as every hard-core, idealist libertarian ever dreamed it is over.

Great Innovation Comes with Great Responsibility

Crypto-preneurs need to solve for three variables on which the LR case, just as the E-Gold case of years back does too, offers glaring lessons. The quotes below are taken directly from the indictment:

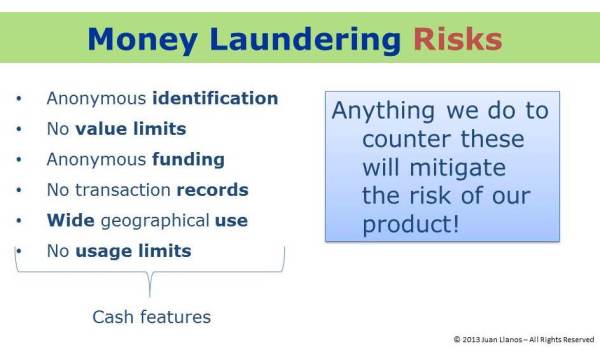

[x] ANONYMITY. They need to successfully address the vulnerabilities on the left-hand side of the graph below. The product has to dissuade the bad element, never attract it.

- “deliberately attracting, and maintaining a customer base of criminals by making financial activity on LR anonymous and untraceable.”

- “designed so that criminals could effect financial transactions under multiple layers of anonymity and thereby avoid apprehension by law enforcement.”

[y] COMPLIANCE. They need to make sure that their product and operations are not in violation of any applicable laws and regulations (the “form” or “paper” side of compliance).

- “was not registered as a money transmitting business with FinCEN”

- “operated an unlicensed money transmitting business.”

[z] SUBSTANCE. They need to make sure that what is written in their policy is actually implemented, that they have operationalized any procedures and controls. And, at the risk of stating the obvious, they need to run their businesses with integrity, responsibility and control (the “substance” part of compliance).

- “intentionally creating, structuring, and operating LR as a criminal business venture, one designed to help criminals conduct illegal transactions and launder the proceeds of their crimes.”

- “lying to anti-money laundering authorities in Costa Rica, pretending to shut down LR after learning the company was being investigated by US law enforcement (only to continue operating the business through a set of shell companies)”

- “created a system to feign compliance with anti-money laundering procedures, […] including a ‘fake’ portal that was manipulated to hide data that LR did not want regulators to see.”

Notice that the Compliance part is the easiest one. As I explained at length in my April 14 post, registering with FinCEN is the least (and cheapest) of the compliance obligations ALL bitcoin exchangers and administrators (including FOREIGN ones servicing US citizens) must implement. Misunderstanding this could have two serious consequences:

a) under-budgeting a crypto-venture by a quarter of a million annually (at a minimum), and

b) exposing the venture to the vulnerabilities that got LR and E-Gold into trouble.

A War Against Bitcoin?

No, I don’t think so. I completely agree with Matt Harris, Managing Director of Bain Capital Ventures, that this has nothing to do with Bitcoin, the alternative currency and its purported threat to the hegemony of the U.S. Dollar. It will definitely have an effect on how Bitcoin entrepreneurs design their product going forward, but it is not (this time around) an attack on the currency itself.

This is all about financial crime. It’s the US Leviathan’s never-ending war against crime. Only this time it’s a financial war waged partially in cyber-space.

Liberty Reserve, described in the indictment as “a financial hub of the cyber-crime world” and “the bank of choice for the criminal underworld,” is obviously an edge case, an outlier. It reminds me of the BCCI case of the late nineties, but this time in the virtual world.

As we can see from the quotes from the indictment above, the alleged criminal activities are reminiscent of organized crime and, if proven, would make Mr. Budovsky and his partners deserving of a place in the Eighth Circle of Dante’s Inferno.

“We Stand By the Guidance”

I’d like to end with a few quotes from FinCEN Director Jennifer Shasky Calvery which highlight what we’ve talked about today:

- “Digital currencies are just a financial service and those who deal in them are a financial institution.”

- “Any financial institution and any financial service could potentially pose an AML [anti-money laundering] threat. It depends on whether folks have the controls in place to deal with those money laundering threats and that they are meeting their AML reporting obligations.”

- “[Virtual currencies are a] part of the financial framework as any other type of financial institution and it has the same obligations as those financial institutions, the same obligations as any money services business out there. For those that choose to act outside of those obligations and outside of the law, they are going to have to account for that.”

- “[Our guidance] is more of a technical guidance on something that already exists.”

- “I think innovation in financial services industry holds out great promise on so many levels for commerce and for social reasons like providing services to the unbanked. But like any financial services, it comes with an obligation and those obligations to protect the U.S. financial system from money laundering need to be taken seriously.”

Finale

In a sense, anonymity is to Bitcoin what copyright infringement was to Napster –the Achilles’ heel that can’t be left unsolved for. Has someone written about the parallels between these two? Interesting topic…

All I have left to say is that IT’S HAPPENING. What I said in early March that would, I mean –“…[that] federal and state regulators and law enforcement agencies might be cooking up cases for regulatory action or even prosecution.”

When faced with what we can’t control, let’s just make the best of it! We would be hard pressed to argue against the value of knowing our customer, right? So, JDI (just do it)! This is a golden opportunity to build a clean and thick customer database from day one.

Let’s JDI!

[QUICK ANNOUNCEMENT: Starting today, I'll be publishing a "CRYPTO-TIMELINE" on the first day of every month. The title is self-explanatory -I plan to include all relevant events in Bitcoin's journey to maturity with links to trusted sources.]